Duxton Farms is an Australian listed entity providing investors with exposure to a diversified portfolio of high-quality, efficient, Australian farms

| DBF | NAV $2.75 |

|---|---|

| Change | Fair Market NAV Per Share as at 31 December 2023 |

| DBF | NAV $2.75 |

|---|---|

| Change | Fair Market NAV Per Share as at 31 December 2023 |

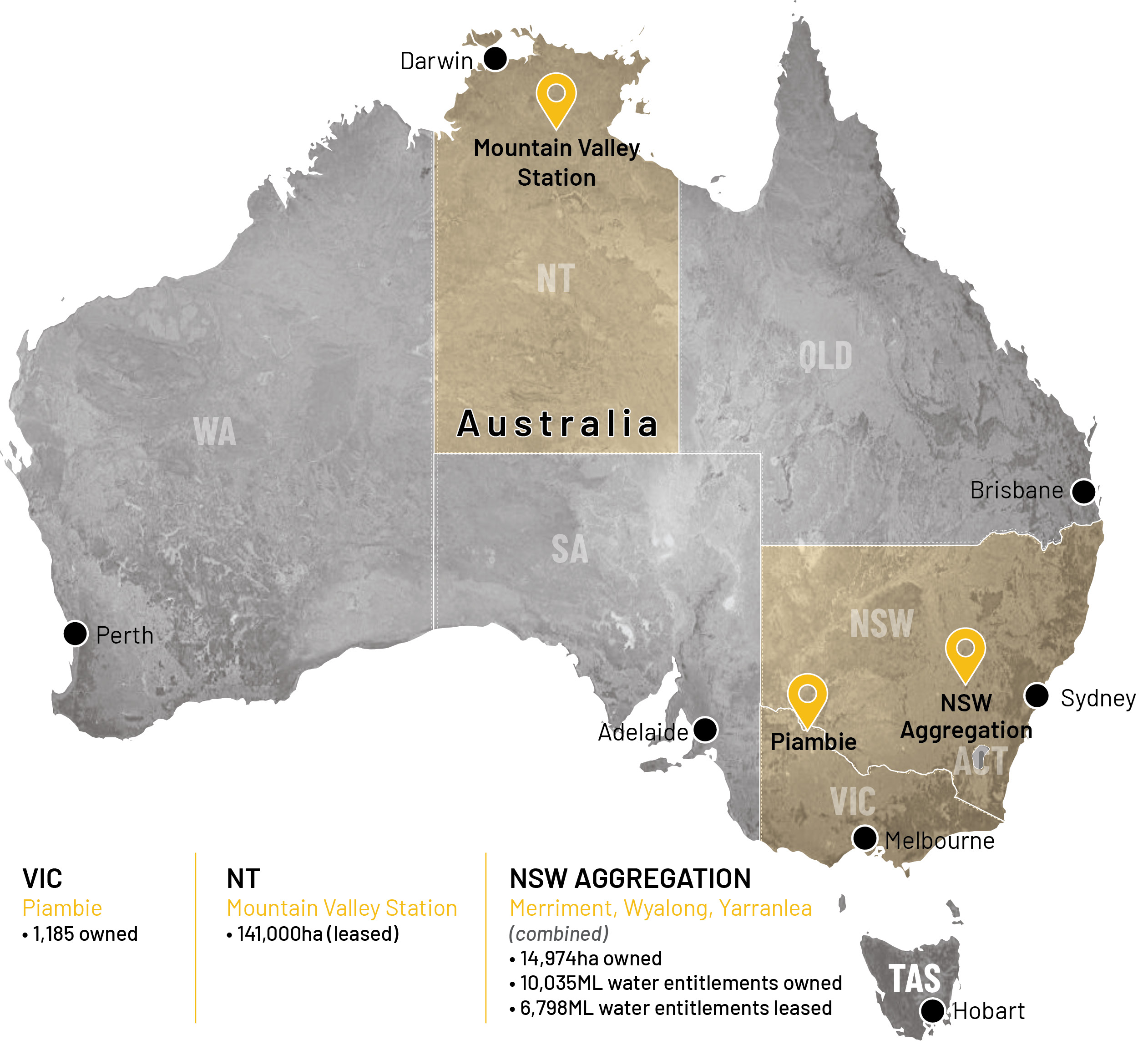

Access to a well-established portfolio of operating Australian agricultural assets producing a diverse range of agricultural commodities.

Best in-class, on-farm management, strengthened by the global agricultural experience of the Investment Manager, Duxton Capital (Australia).

Risk is mitigated and returns optimised through mixed commodity production, long-term water security, and the strategic development of properties.

Duxton Farms continues to seek land-rich parcels for continued growth, scale, and diversification.

SQM Research rates Duxton Farms 4 stars high investment grade

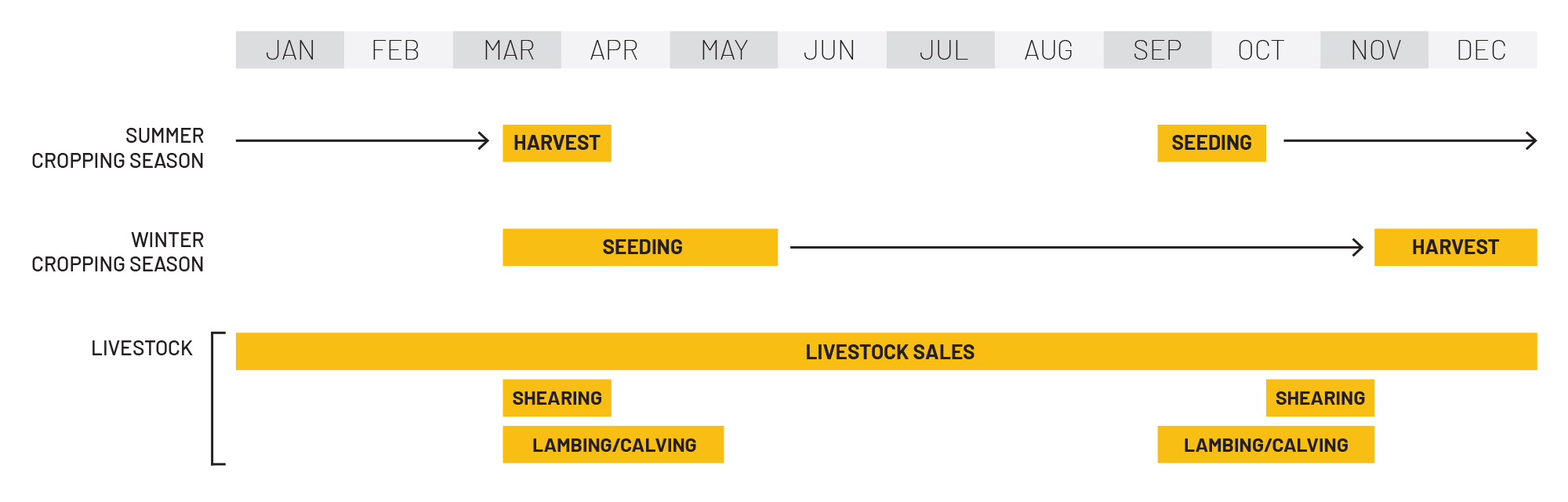

The harvest for the 2023/24 winter crop was finished in late December, with a small area of barley having been delayed due to rain. Overall yields and quality were good across the harvested area, with barley yields averaging over 4.8 t/ha, wheat at 3.1 t/ha and canola at just under 2 t/ha for the aggregation. At least 75% of the barley harvested went to malting quality, while at least 74% of the wheat harvested was graded above ASW1, which is the Company’s de facto internal quality benchmark. Large quantities of barley straw have been baled to support the Company’s livestock programme and for sale off farm, while spraying has commenced on fallow country post-harvest.

The Company’s cotton crop has been growing reasonably well throughout the quarter, although cold morning conditions did slow growth somewhat. The crop has been irrigated twice and is expected to perform well over the next quarter as warm and dry conditions should help the crop’s development. Lucerne was cut and baled over the month at Cowaribin and Merriment.

The Central West of New South Wales (Forbes Airport AWS) recorded 132mm of rainfall over the quarter, below the historical mean of 177mm, but with a wetter finish than would be normal. Forbes received 385mm of rainfall for the 2023 calendar year, which was 61% below 2022 and 36% below the long-term average. Mean maximum temperatures rose from 27°C for the month of October up to 33°C in December, is slightly above the long-term average for the area.

Livestock markets have generally softened, although the Company’s sheep and cattle continue to sell at the top of the market. The Company has a large excess of feed, which will be sold on market given that pastured areas have grown well over the quarter.

The Operations Team harvested a small winter crop of approximately 440t of grain. Given the Company had not expected to harvest any winter crop from the property this season this represented an unbudgeted increase in production with minimal operating costs.

Forage sorghum was planted during December for hay production which will be used to support the livestock programme. A large planter was also sent to the Station to facilitate the development of its cropping plan.

All livestock were turned out for the wet season, with the first muster to start with the onset of the dry season in May.