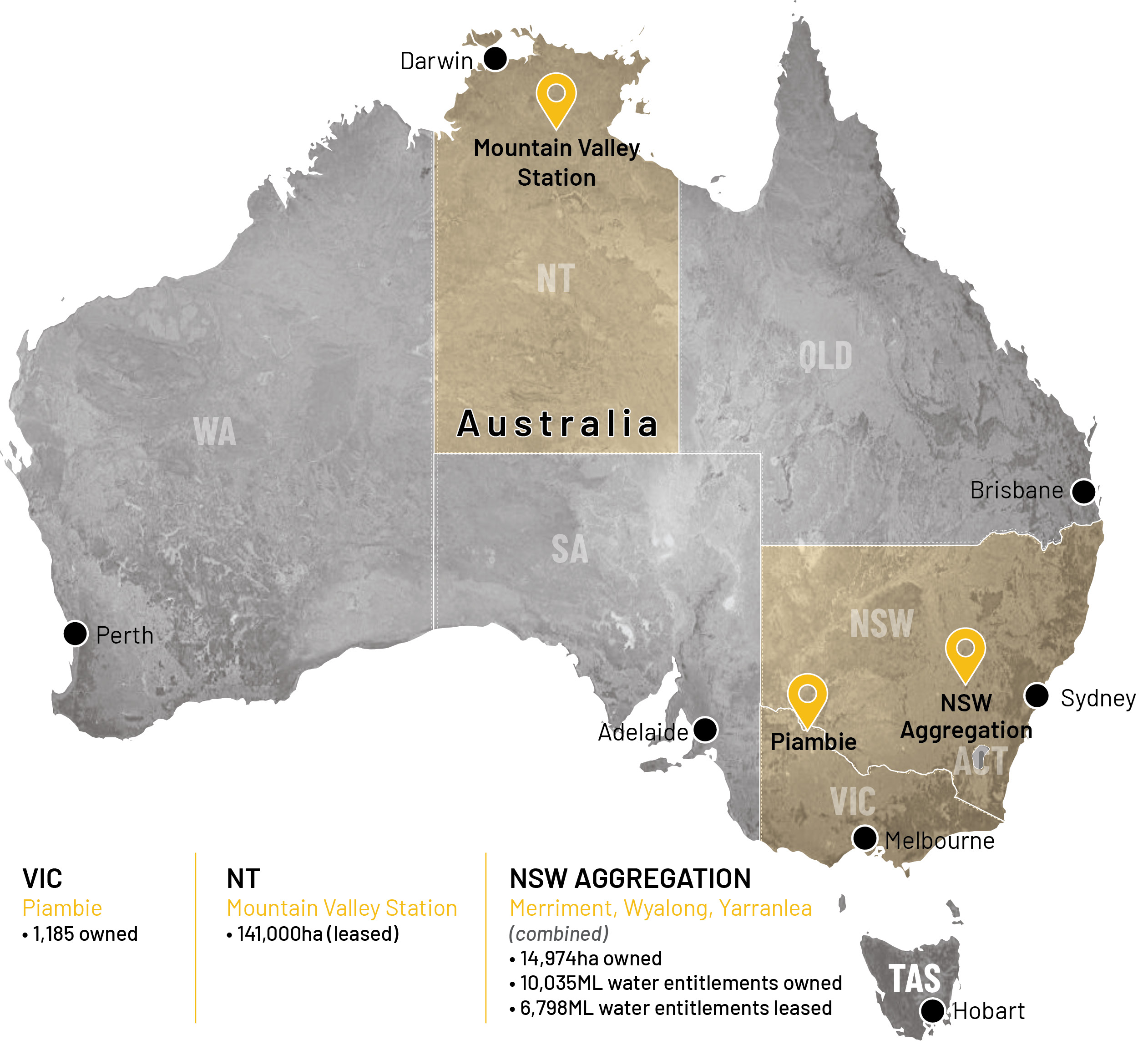

Duxton Farms is an Australian listed entity providing investors with exposure to a diversified portfolio of high-quality, efficient, Australian farms

| DBF | NAV $3.03 |

|---|---|

| Change | Fair Market NAV Per Share as at 30 June 2024 |

| DBF | NAV $3.03 |

|---|---|

| Change | Fair Market NAV Per Share as at 30 June 2024 |

Access to a well-established portfolio of operating Australian agricultural assets producing a diverse range of agricultural commodities.

Best in-class, on-farm management, strengthened by the global agricultural experience of the Investment Manager, Duxton Capital (Australia).

Risk is mitigated and returns optimised through mixed commodity production, long-term water security, and the strategic development of properties.

Duxton Farms continues to seek land-rich parcels for continued growth, scale, and diversification.

SQM Research rates Duxton Farms 4 stars high investment grade

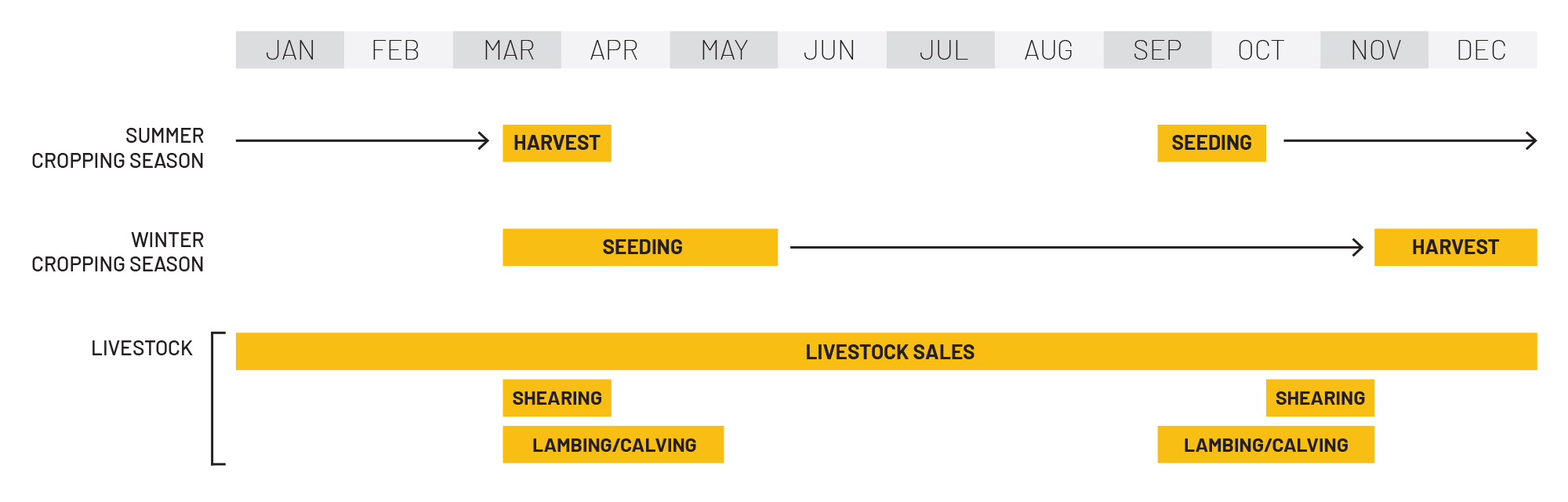

The 2024 winter crop was harvested before the start of the Quarter, with sowing for the new season having commenced with canola and early wheats being sown during April across all farms. Hot dry weather has reduced surface moisture, but rain in early April across all farms has given the Company strong planting conditions for the upcoming winter crop.

The cotton crop finished well in the hotter-than-usual autumn weather, and picking will commence at the start of Q4. Yields for the 2024 cotton crop are looking promising for most areas, while preparation is continuing for next summer’s cotton crop with all country having been hilled up at Yarranlea and Walla Wallah.

The 2024 winter crop was harvested before the start of the Quarter, with sowing for the new season having commenced with canola and early wheats being sown during April across all farms. Hot dry weather has reduced surface moisture, but rain in early April across all farms has given the Company strong planting conditions for the upcoming winter crop.

Overall, Livestock sales have remained steady over the quarter with pricing recovering reasonably well. Sales of livestock have been undertaken as soon as they as they meet the market specifications, and all lambs and calves are at Merriment or Cowaribin to enable easier management. The Company will continue to trade livestock as opportunities arise with prudent purchasing as and when available.

Winter crop preparation for the next season year is progressing with plans for 560 hectares to be cultivated. Trees in the first stage of the Company’s pistachio development at Glenn Innes are doing well with budding completed and trees pushing their growth following additional fertiliser and water application. Work has started on the fertiliser and compost spreading for tree mounds at the second stage ready for planting later in the calendar year. Contractors have started relevelling fields at Piambie for the remainder of the planned Stage Two tree planting area.

The wet season ran late with most of the grazing country still reasonably wet, meaning mustering will be delayed to the middle of May, although hired farm hands are on farm ready to commence as soon as the weather allows (this will limit the number of cattle sold this financial year). As conditions dry down the forage sorghum planted this season will be baled for use on farm. Floodway fencing has been patched and cattle moved in the last month, and additional fencing will be undertaken as conditions allow.